Franchise Buyer Persona Profile: The Semi‑Absentee Executive

Welcome to the fourth installment in our franchise buyer persona series. As we’ve discussed previously, each persona reflects a different type of candidate, defined by background, motivation, and decision-making style. For franchisors, understanding these profiles is key to attracting, engaging, and supporting the right owners for the system.

In this installment, we take a closer look at the Semi-Absentee Executive franchise buyer persona. This group is made up of mid- to late-career professionals and investors looking for manager-run franchise assets they can own while keeping their primary careers and lifestyles. They are not trying to “buy a job.” Instead, they want to use capital, leadership skills, and structured oversight to create a scalable business that fits alongside an existing professional role.

Below, we’ll break down the defining traits, motivations, pain points, and franchise preferences of the Semi-Absentee Executive. We also cover how these buyers think about timelines, capital risk, and why proof of a true manager-run model is non-negotiable for them. We will also explore the operational and psychological challenges that come with balancing a demanding career while owning a semi-absentee franchise.

Finally, we will outline practical marketing strategies and messaging insights to help franchisors connect with and convert this persona. From educational content and ROI-focused webinars to proof-driven case studies and structured nurture campaigns, each section is designed to offer actionable guidance for engaging Semi-Absentee Executives as they move toward franchise investment.

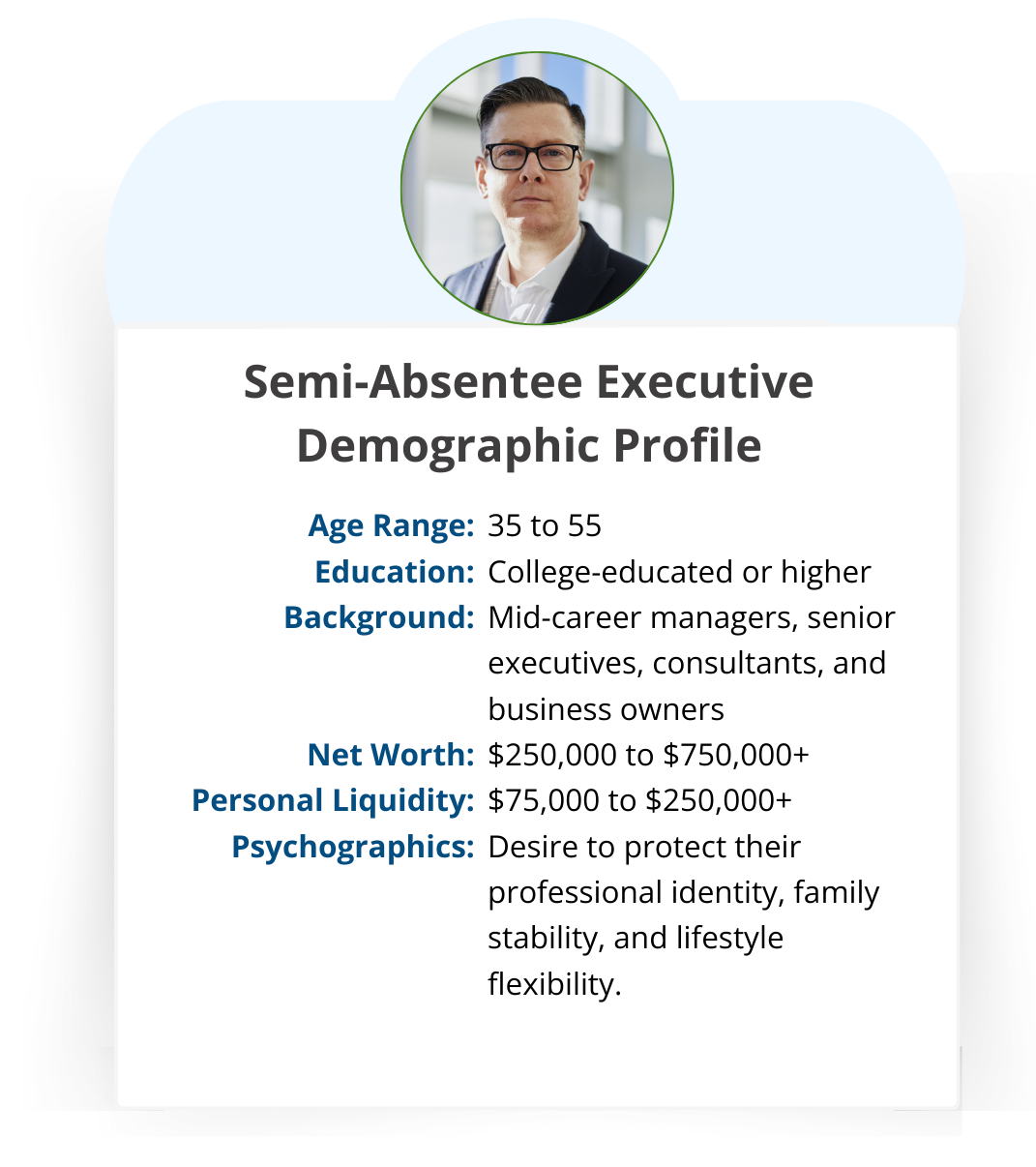

Who Is the Semi-Absentee Executive?

The Semi-Absentee Executive is a mid- to late-career professional or investor who wants to build a manager-run franchise asset while maintaining their primary career and lifestyle. In most cases, they expect to invest around 10 to 20 hours per week in strategic oversight rather than day-to-day operations, especially once the business is launched and stable.

Demographically, this persona often falls in the 35 to 55 age range. It includes mid-career managers, senior executives, consultants, and business owners. There is also a growing segment of millennial professionals in this group who want income diversification without stepping off their core career path.

Within this persona, educational backgrounds are typically strong. Most are college-educated or higher and come from fields like management, sales, finance, engineering, or professional services. They are comfortable managing teams, tracking P&Ls, reading dashboards, and making decisions based on performance data.

From a financial standpoint, the semi-absentee typically has a net worth in the $250,000 to $750,000 range or higher. Liquid capital often falls between $75,000 and $250,000 or more. Their access to capital sources comes from 401(k) rollovers, home equity lines, or portfolio loans. That level of capital generally allows them to qualify for standard franchise investments and, in some cases, multi-unit commitments.

Time availability is one of the clearest defining traits. In a mature state, these owners expect to spend roughly 10 to 20 hours per week working on the business, not in it. That time is usually organized into blocks before or after work and on weekends, focused on KPI reviews, manager coaching, and strategy.

Psychographically, Semi-Absentee Executives tend to think like investors and portfolio builders more than traditional owner-operators. They care about:

Return on capital

Risk management

Scalability

At the same time, they want to protect their professional identity, family stability, and lifestyle flexibility.

What Motivates the Semi-Absentee Executive to Buy a Franchise?

Motivations for the Semi-Absentee Executive center around building assets, diversifying risk, and leveraging time. Unlike buyers who want a full career change, this persona is focused on layered wealth and long-term options, not immediate job replacement.

Several core motivations show up consistently.

Build a scalable asset while keeping their career. A semi-absentee franchise gives them a path into entrepreneurship or multi-unit ownership without forcing an immediate exit from their primary job. They see the business as one pillar in a broader financial plan, not a single make-or-break move.

Diversify income and reduce concentration risk. Many Semi-Absentee Executives are highly aware of how vulnerable it can feel to rely on one employer, one industry, or one income stream. A manager-run franchise is attractive because it can create a second, transferable revenue source that is not tied to their day job.

Leverage time. The ability to turn capital and management skill into cash flow, without being on-site every day, is central to this persona. They want to apply leadership and oversight tools without being stuck in daily operations.

Future optionality. By building a semi-absentee business, they create options such as:

Stepping out of corporate life later into a business that is already operating.

Transferring the asset to family members.

Building a small portfolio of units that can be sold or recapitalized down the road.

Lifestyle and control. They want more say over their schedule and long-term decisions while avoiding the identity disruption that can come with a full-time owner-operator role. For many, the ideal outcome is a resilient business run by a capable manager, while the owner focuses on strategy, culture, and growth.

What Types of Franchises Draw Semi-Absentee Executives?

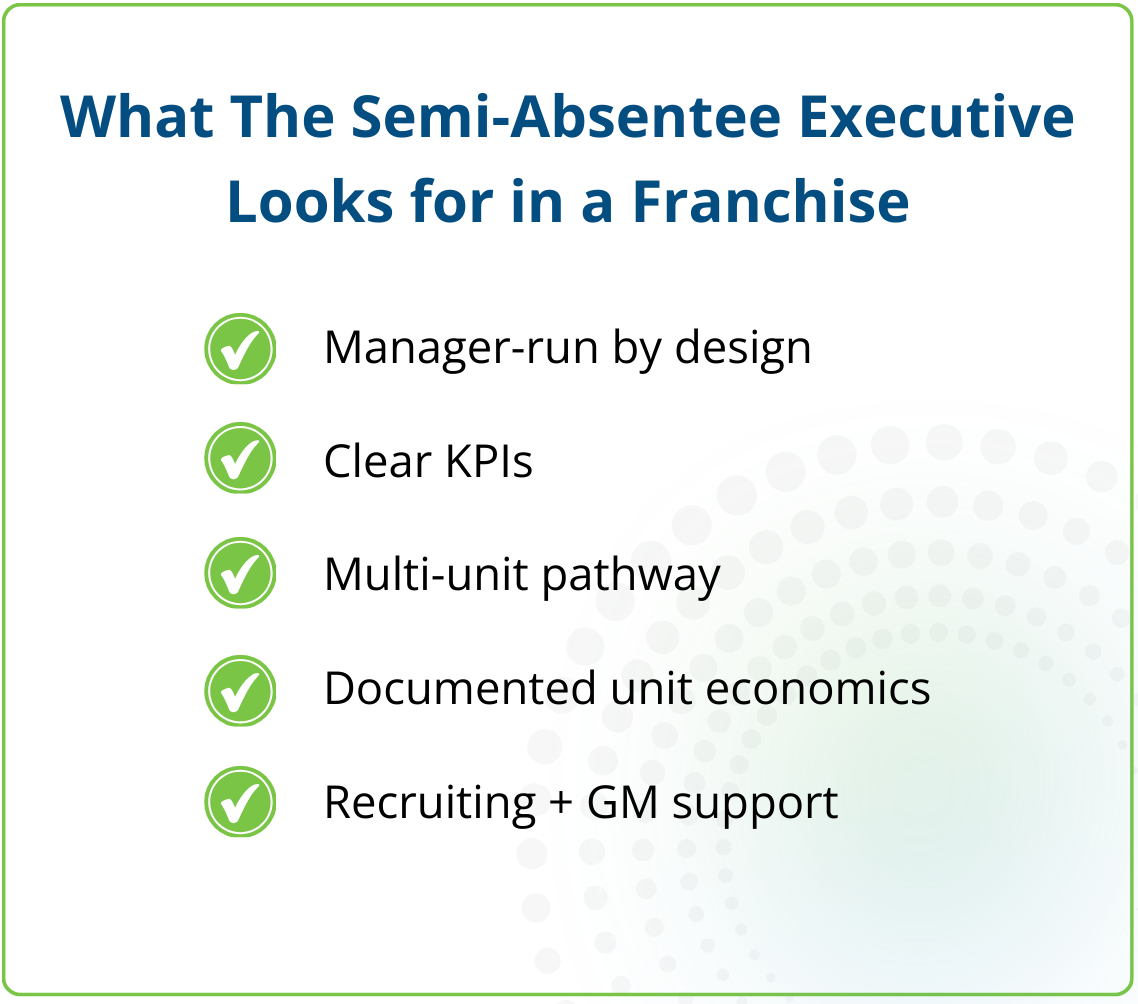

Semi-Absentee Executives are picky about business models. They look for concepts designed to work with a manager in place, not models that are trying to squeeze into semi-absentee language after the fact. For this persona, model fit is not a minor detail. It is the first filter.

They prefer operating models that:

Are intentionally built for manager-run or semi-absentee ownership.

Offer clear org charts, role definitions, and playbooks for a general manager and key staff.

Include defined KPIs and reporting rhythms that support remote or part-time oversight.

In terms of categories, Semi-Absentee Executives often gravitate toward:

Multi-unit friendly service models such as home services, B2B services, fitness, and youth activities that can support repeat revenue and multiple income streams.

Brick-and-mortar or suite-rental models where the owner focuses on leasing, marketing, and manager accountability rather than delivering services personally.

Economically, they look for franchises that offer:

Mid-range investment levels relative to their net worth, avoiding ultra-low-cost concepts that may not scale and ultra-high-ticket models that concentrate too much risk in one location.

Strong and well-documented unit-level margins.

Realistic, evidence-backed pathways to multi-unit growth once a location is stable under a general manager.

Because they evaluate opportunities through an investor lens, Semi-Absentee Executives pay close attention to how franchise economics fit into their broader financial plan. They compare potential returns not only against other franchise brands, but also against real estate, public markets, and private investments.

How Much Capital Do Semi-Absentee Executives Typically Have Available?

Semi-Absentee Executives are usually well-capitalized, but they are rarely casual about risk. They want to understand exactly how much capital is required, how it will be used, and how quickly it can realistically be recovered.

From a liquidity standpoint, many Semi-Absentee Executives have:

Between $75,000 and $250,000 or more in liquid assets, including cash, brokerage accounts, or retirement funds.

The ability and willingness to allocate capital when the opportunity fits their risk and return requirements.

From an overall investment perspective, they tend to target:

Franchise concepts in the standard investment range, where total costs (including working capital) align with their diversification goals.

Deals that do not require committing the majority of their net worth to a single unit, since that works against their preference for spreading risk.

Because their mindset overlaps heavily with the ROI-Driven Investor persona, they scrutinize capital efficiency, payback periods, and downside scenarios before making a commitment.

What Pain Points Do Semi-Absentee Executives Face?

Even though semi-absentee ownership has real advantages, this persona runs into a specific set of challenges when evaluating and operating franchises. These pain points often determine whether they move forward or walk away.

One major challenge is time bandwidth during launch. Early franchise stages are rarely truly semi-absentee. Many Semi-Absentee Executives must commit 15 to 25 hours per week or more during startup, which can strain already demanding corporate roles and personal commitments.

A second pain point is hiring and keeping a strong manager. Recruiting, trusting, and retaining a general manager is both the foundation and the biggest risk in this model. A poor early hire can hurt performance, damage morale, and shake the owner’s confidence in the concept.

Third, they run into proof gaps. Semi-Absentee Executives want real evidence that the model works under real conditions. They look for:

Existing semi-absentee franchisees with whom they can speak directly.

Clear examples of locations performing well with owners in similar work and life situations.

Documentation of how the franchisor supports manager-run operations.

Fourth, many experience role identity conflict. They are used to being the primary leader. Shifting into a governance-style role can feel unclear unless they are given a concrete framework for managing through metrics, meetings, and structured touchpoints rather than daily presence.

Finally, they fear underperforming while distracted. Semi-Absentee Executives often worry that splitting attention between a full-time job and a new business could lead to average results in both areas, which could harm their reputation, financial stability, or career momentum.

These pain points make transparency critical. Franchisors need to be clear about time requirements, support levels, and the real-world demands of running a manager-driven operation.

What Financial Concerns Prevent Semi-Absentee Executives from Investing?

Semi-Absentee Executives are ROI-driven and cautious. Several financial concerns can cause them to pass on an opportunity, even when they like the brand or category.

Common blockers include:

Weak or unclear unit economics reduce confidence. Limited or inconsistent Item 19 earnings disclosures, vague break-even ranges, and large gaps between average and median results create doubt. This persona wants strong financial transparency and supporting details before they commit capital.

Cash-flow timing. Semi-Absentee Executives are sensitive to long ramp-up periods. If they cannot be in the business full-time to accelerate sales, they want conservative assumptions about how long it will take to reach break-even and target margins.

Capital at risk against vs. Level of involvement. Many semi-absentee models require similar investment levels as full-time owner-operator concepts, but with less direct control. That makes downside scenarios feel more serious, especially when results depend heavily on one manager or a small team.

Debt load and personal guarantees. Many Semi-Absentee Executives are hesitant to take on large SBA loans or sign guarantees that could affect family finances or other investments. They want realistic models showing how debt service interacts with ramp-up and cash-flow swings.

Manager and payroll risk. Concerns about labor costs, turnover, theft, and mismanagement are amplified when the owner is not present daily. Without strong monitoring systems and margin protection tools, this risk can outweigh the potential upside.

What Timeline Do Semi-Absentee Executives Follow?

The investment timeline for Semi-Absentee Executives is usually deliberate and structured. They tend to move through a multi-stage process that includes education, brand comparison, financial modeling, and validation before committing.

Their evaluation process often takes several months. During that period, they typically:

Gather high-level information on semi-absentee ownership and specific brands.

Narrow down to a short list of concepts that match their capital, schedule, and management preferences.

Go through structured discovery, unit-level financial reviews, and franchisee validation calls.

Bring spouses or key family members into the decision to ensure alignment.

Timelines tend to compress when they see a clear fit between the concept and their goals. Decisions move faster when:

The capital requirement and projected returns match their financial plan.

They can quickly speak with multiple semi-absentee owners who confirm the model.

Employer changes, industry shifts, or market events increase the urgency to diversify or build a second income stream.

Because they treat franchise investment like a serious capital allocation decision, Semi-Absentee Executives rarely move on impulse. They want a process that respects their need for thorough analysis.

What Content and Messaging Resonate with Semi-Absentee Executives?

Marketing to the Semi-Absentee Executive works best when it reflects their professional experience, limited time, and analytical mindset. They respond to structured information, not hype or lifestyle-only messaging.

Several content themes consistently perform well.

Proof of a true semi-absentee model is essential. They look for:

Case studies and video testimonials from owners who kept full-time careers while building manager-run franchises.

Specific descriptions of weekly time commitments during startup, stabilization, and growth.

Clear explanations of what the owner actually does in each phase and how the GM role functions day to day.

Economic clarity is another priority. Semi-Absentee Executives want:

Clean visual breakdowns of total investment, working capital, cash-flow curves, and payback windows.

Sensitivity ranges that show slower-than-plan scenarios and how they affect cash, debt service, and owner income.

Comparisons to other capital uses, such as public markets or real estate, framed around diversification and equity creation rather than promotional claims.

Risk mitigation messaging also carries weight. They respond to:

Detailed explanations of training and support for managers.

Structured recruiting and hiring processes provided by the franchisor.

Dashboards and KPI systems that give the owner strong control without daily presence.

Lifestyle positioning can support the story, but it cannot replace the rational elements. Realistic examples of owners balancing an executive role, family life, and franchise oversight help make the model feel achievable. Content that shows how a unit can become more independent over a three- to five-year horizon tends to resonate strongly.

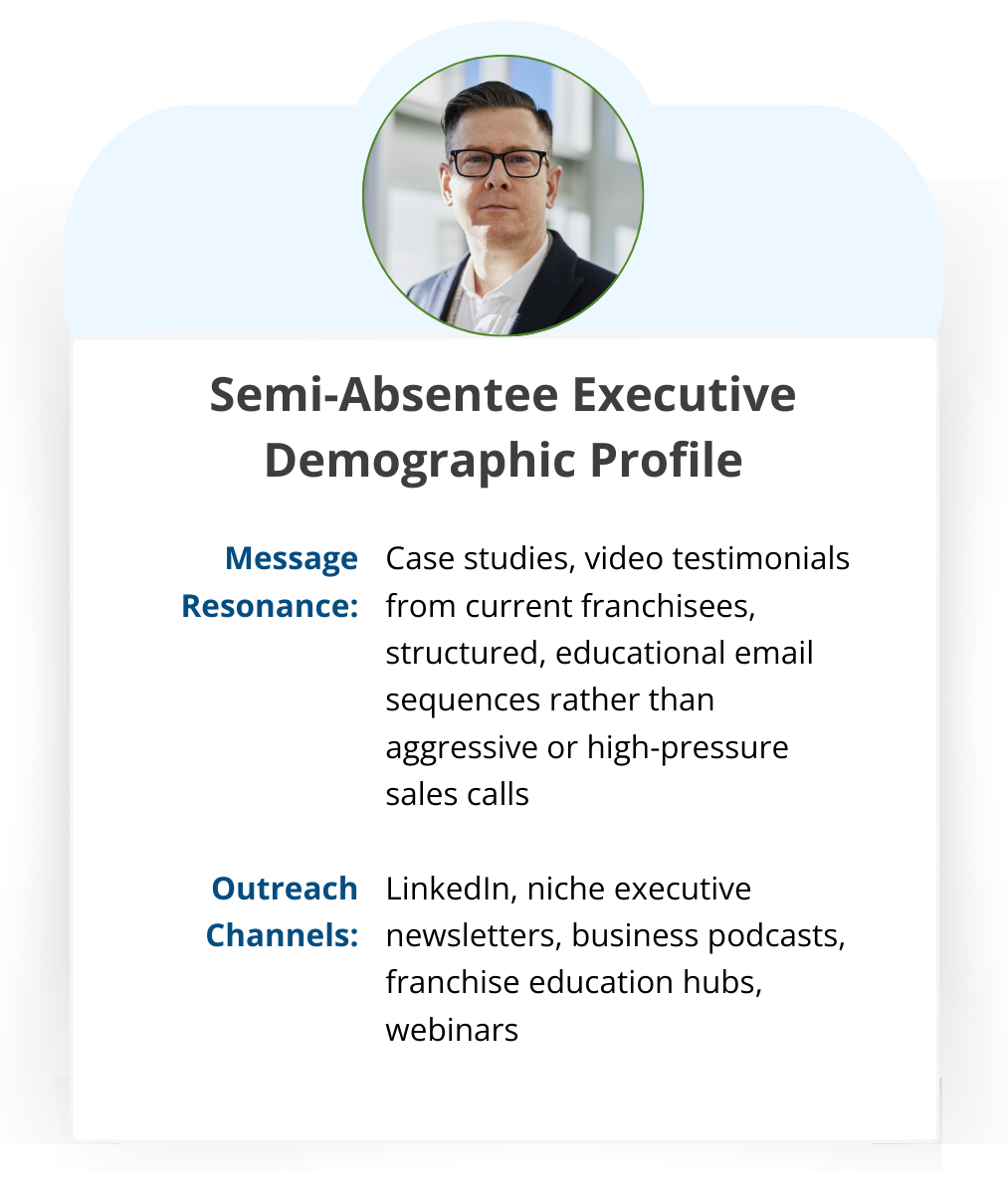

Messaging and Tactics Overview

Several messaging themes consistently resonate with Semi-Absentee Executives. From a positioning standpoint, they respond to the idea of a manager-run asset that they can build while continuing their primary career.

In terms of proof, they look for case studies featuring real semi-absentee owners, complete with clear information about time commitments and return on investment. The most effective content formats include webinars, ROI-focused breakdown articles, and concise executive-level one-pagers or briefings.

For follow-up, they prefer structured, educational email sequences rather than aggressive or high-pressure sales calls. Overall, this persona expects communication that is professional, concise, and grounded in data, reflecting the way they already make decisions in their careers.

What Outreach and Marketing Strategies Work Best?

Reaching Semi-Absentee Executives requires showing up where they already consume business and investment information. They tend to spend time in professional platforms and curated networks, not broad consumer channels.

Effective channels include:

Professional platforms such as LinkedIn, where targeted content, sponsored posts, and thought leadership can reach executives exploring income diversification.

Niche executive newsletters and business podcasts focused on leadership, investing, and entrepreneurship.

Franchise education hubs where serious candidates research models, economics, and ownership structures.

Broker and consultant networks also matter. Many Semi-Absentee Executives work with franchise consultants who pre-qualify them for semi-absentee-friendly models and help match investment levels to financial goals.

On the tactics side, brands can use:

Educational funnels built around guides like “How semi-absentee franchise ownership really works,” “Questions to ask about manager-run models,” and “Comparing franchises to other investments.”

Performance-focused webinars and small-group briefings that walk through unit economics, oversight structures, and panels of existing semi-absentee owners.

Retargeting and nurture sequences that start with high-level lifestyle and diversification hooks, then move into more detailed financial and operational proof over time.

Throughout the process, the tone should stay consultative and professional. Semi-Absentee Executives respond far better to structured education and data-driven conversations than aggressive sales tactics.

What Solutions Help Overcome Doubts and Hesitations?

Moving Semi-Absentee Executives from cautious interest to committed ownership requires addressing their biggest fears directly. The best solutions reduce both structural risk and personal uncertainty.

Several strategies can help.

First, brands can show true model fit for semi-absentee ownership. This includes:

Providing clear documentation of owner time expectations during launch, stabilization, and growth.

Sharing examples of manager-run locations that match the prospect’s work and family situation.

Explaining how the franchisor supports semi-absentee owners through training, coaching, and tools.

Second, brands can explain how they reduce the perceived manager risk by offering:

Recruiting support and vetted job profiles for general managers.

Interview frameworks and structured hiring processes.

Training programs for managers and contingency plans for turnover, including backup candidates and escalation paths.

Third, brands can clarify capital and cash-flow expectations. This involves:

Helping prospects build conservative, line-item financial models, including total investment, working capital, and reserves.

Showing break-even ranges and “what if” scenarios for slower sales or higher costs.

Explaining how debt, if used, interacts with ramp-up and cash-flow cycles.

Fourth, they can provide governance tools. Semi-Absentee Executives want:

Dashboards and reporting systems that show key KPIs at a glance.

Recommended meeting cadences with managers.

Clear escalation processes for operational or financial issues.

Finally, brands can normalize the role transition. They can:

Share playbooks for managing a semi-absentee business while keeping a primary career.

Provide access to peer communities of similar executives.

Highlight stories of professionals who built semi-absentee portfolios successfully over time.

By combining transparency, operational support, and real peer proof, franchisors can create a credible path that helps Semi-Absentee Executives move forward with confidence.

What’s Up Next?

This article provides an in-depth look at the Semi-Absentee Executive franchise buyer persona. It highlights who they are, how they think about capital and time, what they look for in franchise models, and which pain points and financial concerns can slow them down. By aligning messaging, support, and deal structure with this persona’s needs, franchisors and marketers can better support their journey into semi-absentee ownership and drive higher-quality growth.

Future installments in this franchise buyer profile series will continue exploring the remaining personas shaping today’s franchise landscape. Don’t forget to review our previous looks at the: